Here are the top five insurance claims Australian SMEs make, according to insurers.

This article will also offer tips to improve your risk management, so you’re less likely to need to claim for any of these events.

#1 Claim: Theft

Theft and burglary are the top claims. Consider these moves to reduce the likelihood of your business being the victim of such crimes.

- Install webcam security, including motion sensor lights

- Lock doors and windows (deadlocks and key-locks) when the premises are unattended

- Be mindful that thieves often enter through a door or window, but can enter via ceiling spaces

- Boost external lighting

- Check employees’ backgrounds, have a clear policy on internal theft and ask them to be alert to thieving in the workplace

- Ensure staff have regular anti-theft policies and training

- Track and manage your inventory with a digital system

- Store valuables and cash in a safe at the close of business daily, and

- Consider investing in a private security service if your premises are in a high crime area.

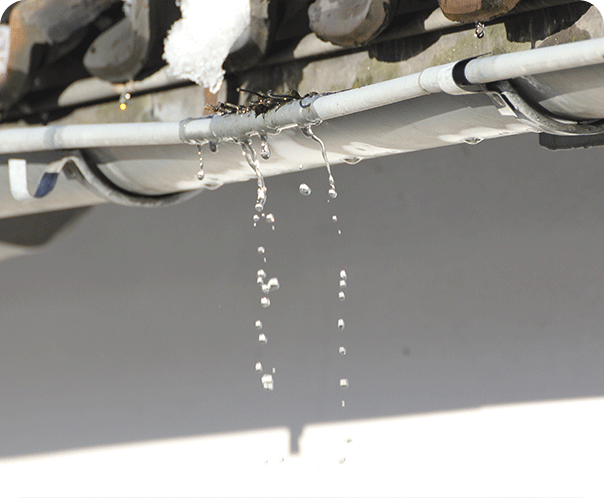

#2 Claim: Storm damage

Storm damage claims rank highly with the increase in storm severity and frequency. Leaking roofs, water-damaged stock, or power surges can damage and disable machinery or electrical equipment. Here’s how to protect your SME:

- Regularly maintain your roof, ceilings and roof space (If tenanted, ensure the landlord regularly conducts maintenance of the structure/premises)

- Check and routinely clear blocked gutters and drains

- Identify flooding or water pooling risks on your site (with the assistance of a plumber) and make adjustments to better manage and direct the flow away from your building

- Trim excess vegetation, especially trees overhanging your building

- Securely anchor outdoor equipment or furniture and store loose items under cover, if possible, and

- Turn equipment and computers off at the power point to prevent potential surge damage.

#3 Claim: Liability claims

Public or product liability claims are also common, making up one in seven claims. Minimise your exposure to being out of pocket for damage to third parties’ property or injury to people. Examples include one of your staff backing into a client’s vehicle or structure, a visitor tripping at your premises, burst water pipes that damage equipment at a neighbouring business, or your products causing injury or damage to customers or third parties.

These tips will help:

- Ensure you have fit-for-purpose quality assurance controls to minimise the risk of product liability claims

- Keep walkways, floors, steps, and stairs dry and clear of trip hazards

- Consider where you can improve visibility in these places with extra lighting

- Restrict public movement in and around the more dangerous parts of your business, such as where machinery is running, or hazardous materials are stored, and

- Adopt policies and systems to make sure staff handle clients’ property carefully.

#4 Claim: Property damage

Accidental and malicious property damage is another major concern, with some insurers saying they account for more than half of overall claims. Be sure to:

- Maintain your business premises with regular repairs and servicing

- Improve your security to deter vandals and other malicious damage, and

- Remove waste material promptly from your site rather than let it build up.

#5 Claim: Machinery/

equipment breakdown

To reduce your risks of machinery or equipment breakdown, which can negatively impact your business, try these approaches:

- Do planned, programmed maintenance and servicing of your machinery and equipment

- Store these items appropriately

- Keep electrical connections free of clutter and dust

- Ensure your gear is used only as intended

- Attend to any incidents, near misses or concerns your operators raise, and

- Have a plan B – a business continuity plan for the unexpected.

Knowing the main risks, and how to better manage them, means you’re better equipped to protect your business.

Boost your risk management strategies with our advice and insurance coverage. This will provide better protection for your business. We’ll also help review your existing coverage and identify any gaps or underinsurance issues.